Tax Refund Procedure

Who can get refund?

Eligible Customers

Minimum purchase of 30,000 KRW, and must leave Korea within three months.

- Foreigner (Stayed in the Republic of Korea less than six months)

- Overseas Resident (two years or more foreign residence/ less than three months of residency in Korea)

- Who has no income in Korea

- Students who resided outside of Korea for over three years.

Refundable items

All value added purchase items in Korea excluding guns, swords, chemicals, drugs, cultural properties.

Ineligible customers

- US Force in Korea

- Diplomat in Korea

- No passport

- Foreigners overstaying

- Foreigners working in Korea

- Agent

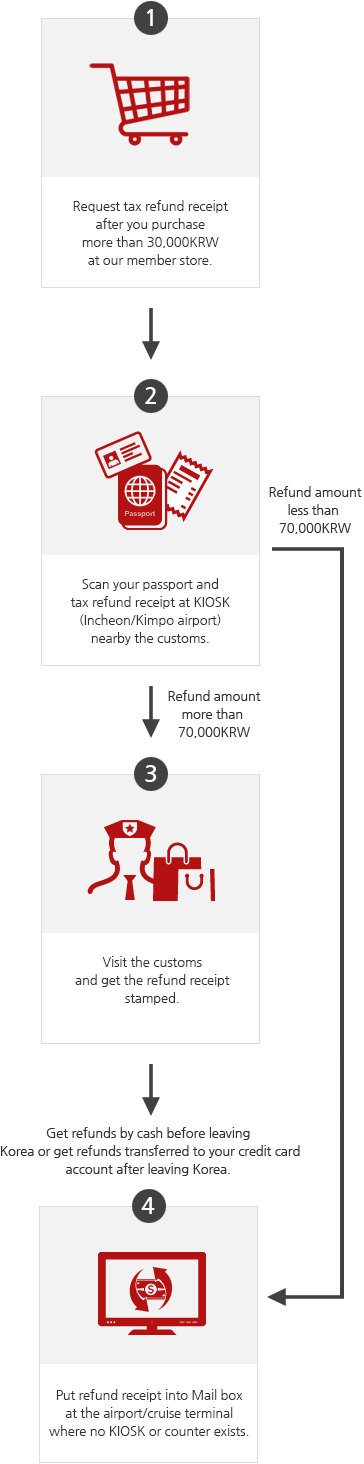

Tax Refund Method

Tax Refund Method

- Get refund by cash at ATM(KIOSK) in the airport (Incheon/Kimpo) before leaving Korea.

- Get refunds transferred to your credit card account (VISA, MASTER,JCB) after leaving Korea.